Global Antitrust in 2024: 10 key themes

Dominance and monopolization

back to the future?

IN BRIEF

The focus on dominance and monopolization investigations is set to further increase in 2024. US agencies show no signs of slowing down their pursuit of alleged anticompetitive conduct, even reverting to older legislation to bring novel monopolization claims. This is matched by active public and private enforcement in the UK, with expansive class action litigation firmly taking root. Europe can expect new draft guidelines on exclusionary abuses, representing the first major reforms in this area since 2008.

.

In detail

Novel monopolization claims in the US

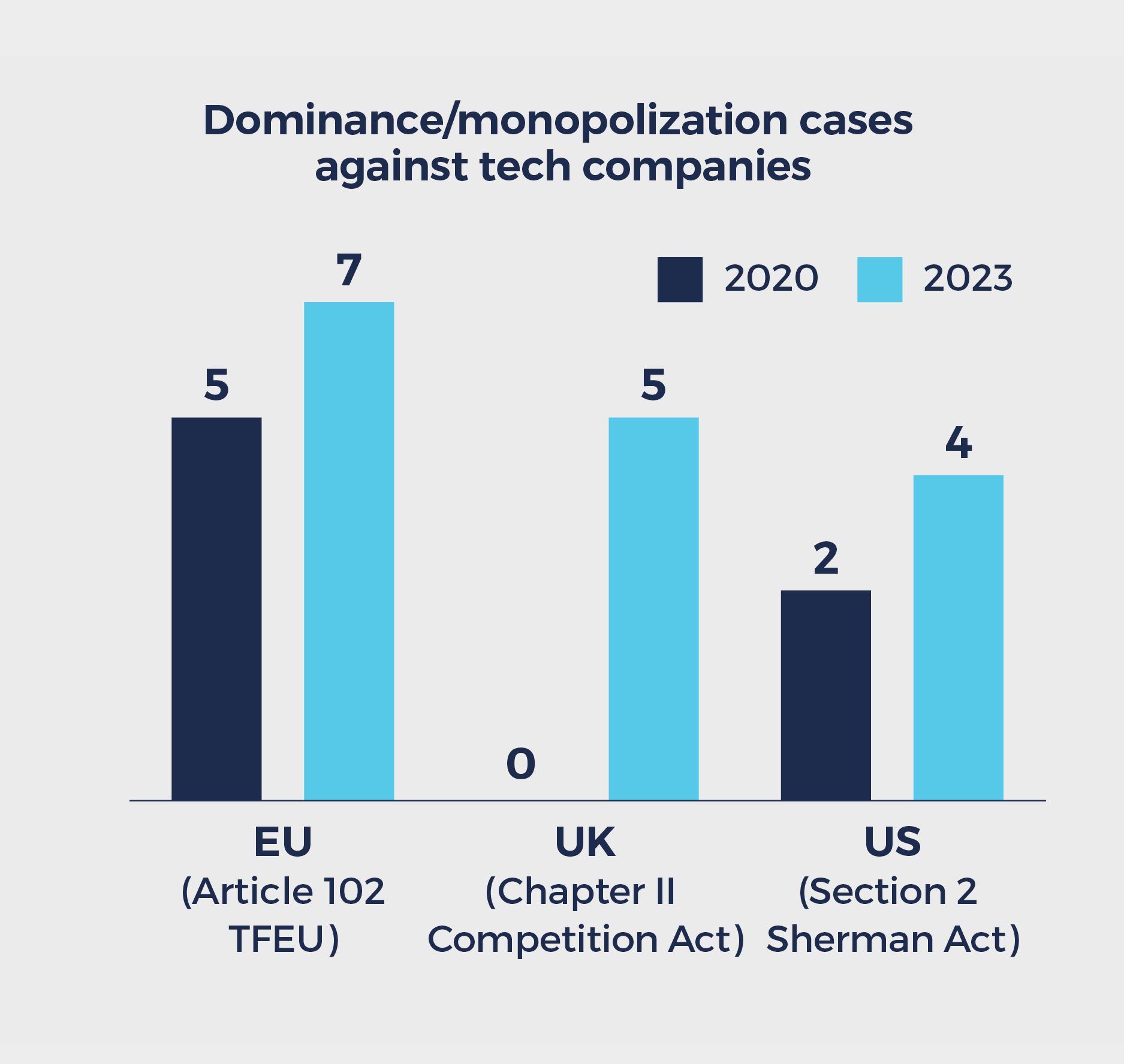

In the US, the US Department of Justice Antitrust Division and the Federal Trade Commission (FTC) are primed to continue their recent push to bring novel monopolization claims – and in greater numbers. High-profile cases against some of the world’s largest technology companies will keep progressing, with the companies’ innovative products contrasting with enforcers’ distinctly old-fashioned approaches.

![]()

US regulators are not only bringing more monopolization cases – they are also seeking drastic remedies in more of those cases. If they prevail, courts could have to decide whether to order a divestiture in a non-merger case for the first time in decades.

Andy Ewalt

Antitrust Partner, Washington, DC

“Unfair practices” under scrutiny

In 2024, all eyes will be fixed on the FTC’s suit against Amazon. Spearheaded by FTC Chair Lina Khan, a longtime critic of the company, the case alleges that Amazon engaged in an unfair course of conduct that enabled it to maintain monopoly power in markets for online superstores and online marketplace services. Five days before suing Amazon, the FTC brought another monopolization case against U.S. Anesthesia Partners (USAP) and its private equity parent, challenging the serial acquisition of more than a dozen smaller anesthesiology practices in Texas over the past decade as part of a “roll-up” strategy.

Notably, both actions include claims under Section 5 of the FTC Act alleging “unfair” practices. As the FTC previewed in late 2022 in its updated Section 5 policy statement, it no longer views its Section 5 authority as limited to challenging historically recognized anticompetitive conduct. Instead, it may challenge any act that it considers an unfair method of competition, an approach the agency has not systematically pursued since suffering a string of court losses in the early 1980s.

Structural remedies back in fashion

The Amazon and USAP cases also illustrate US regulators’ reversion to 1960s-era structural relief as their preferred remedy for monopolization concerns. In USAP, as in some of the agencies’ other recent monopolization suits, the FTC explicitly seeks to break up the formerly independent anesthesiology practices. And in Amazon, the FTC’s cagey request for “structural relief” leaves open the possibility that it may yet try to break up the company.

Active public and private enforcement in the UK

In the UK, active public and private enforcement continues apace. Recent public enforcement has centered on the technology and pharmaceutical sectors. The Competition and Markets Authority (CMA) has been successful at the UK Competition Appeal Tribunal (CAT) in excessive pricing cases in the pharmaceutical sector – cases that have historically been difficult to prove. The focus on large tech companies will continue as the CMA looks to settle allegations of abusive conduct in a number of cases and to progress other investigations in the digital sector.

![]()

The multiple ongoing CMA abuse of dominance investigations into large tech companies are expected to spawn damages claims based on the alleged abusive conduct. Indeed, the CMA is actively encouraging customers of those companies to seek compensation.

Mark Sansom

Antitrust and Dispute Resolution Partner, London

Class actions booming and categories of abuse expanding

In private enforcement, 2024 will see heavy use of the UK’s antitrust-only opt-out class action regime to target tech companies. A number of these actions are already before the CAT.

It is now common for such class actions to be brought on a standalone basis – i.e., without any prior competition authority investigation or decision – and to be based on expansive allegations of abuse that go well beyond established precedent. Categories of abuse are being broadened to encompass general consumer protection issues, such as information opacity, product liability, data breaches and environmental protection.

A permissive approach to class certification by the CAT and the continued availability of significant litigation funding (notwithstanding the recent outlawing by the UK Supreme Court of certain funding agreements) will see claimants continue to pursue these novel theories of harm, deploying competition law to what are in fact general consumer claims. Hopefully the CAT (and the appeal courts) will shortly clarify whether the law on the abuse of dominance is the appropriate tool to address issues historically dealt with by the CMA’s consumer protection and market investigation tools. Meanwhile, consumer-facing companies face significant risk from such class actions.

Lowering the bar for intervention in the EU

In March 2023, without prior consultation, the European Commission (EC) published a revised version of its 2008 guidance on enforcement priorities for abusive exclusionary conduct by dominant undertakings (Guidance). In parallel, it also launched a public consultation on a new set of guidelines, a draft of which is expected to form the basis of a consultation in June 2024.

![]()

The European Commission is determined to bring dominant companies to heel and has changed its policy guidance to give it greater leeway. A resurgence in investigations against exploitative abuses at the EU or national level is also possible due to the difficult macroeconomic context.

Bertrand Guerin

Antitrust Counsel, Berlin/Silicon Valley

The March amendments reduce the importance of the effects-based, or “economic,” approach to abuse cases under Article 102 of the Treaty on the Functioning of the European Union – in particular, the application of the “as-efficient competitor” (AEC) test – thereby lowering the bar for intervention. The revised Guidance now recognizes that in certain (unspecified) circumstances, companies that are not (yet) as-efficient competitors may also warrant protection from exclusionary behavior by dominant companies.

The revised Guidance also lowers the bar on what the EC considers constitutes “anti-competitive foreclosure”. That bar is no longer set at exclusion of competitors linked to the ability of the dominant company to profitably increase prices. Instead, it is sufficient if the dominant company’s conduct adversely impacts an effective competitive structure of the market, allowing it to “negatively influence” the parameters of competition (such as price and innovation) – without the need to show the strategy is profitable.

Although the revised Guidance is aimed at “enhancing transparency on the principles underpinning the Commission’s enforcement action”, it is uncertain whether the changes make it more difficult for companies accused of abusing a dominant position to defend themselves in an investigation. At the very least, the revisions bring with them a loss of legal certainty. For example, how will the revised Guidance impact companies’ ex ante self-assessment? How should companies know whether an AEC test is considered appropriate in their market and – where it is – which elements could outweigh its application? Time will tell.

Looking ahead in 2024

- Consider contributing to the EC’s consultation on its draft guidelines on exclusionary abuses of dominance.

- Take account of possible public or private intervention alleging abuse of dominance when assessing possible transactions involving a dominant company.

- Be aware of the heightened risk of competition authorities pursuing structural remedies, up to and including divestitures in monopolization cases.

- Consumer-facing companies should be alert to the risk of investigations into alleged abusive pricing conduct, and also to private class actions based on broad notions of consumer harm.

- Monitor the results of pending cases in relevant jurisdictions to gauge the extent to which robust agency action is endorsed by the courts.

With thanks to Bola Ajayi, Tyler Garrett and Joanna Goyder for their contributions to this theme.

- Introduction

- 01. Taking center stage global antitrust for the mid-2020s

- 02. Merger enforcement the path to clearance gets even tougher

- 03. Investing across borders in 2024 – strengthened controls to protect domestic capabilities

- 04. Digital markets antitrust and artificial intelligence – the next frontier?

- 05. Consumer driven enforcement consumer facing businesses in the regulatory spotlight

- 06. In focus: life sciences and pharma – conduct and commercial practices under the microscope

- 07. Antitrust and sustainability will 2024 bring regulatory alignment or will the chilling effect of uncertainty persist?

- 08. Dominance and monopolization back to the future?

- 09. Antitrust investigations uptick in enforcement with tougher powers and increased interagency cooperation

- 10. Cross-border claimant strategies – focused on investigations and litigation

- Download the full report

Authors

-

Andrew Ewalt Partner

Washington, DC

-

Bertrand Guerin Counsel

Berlin, Silicon Valley

-

Mark Sansom London and Dublin Managing Partner

London, Dublin