Global Antitrust in 2024: 10 key themes

Merger enforcement

the path to clearance gets even tougher

IN BRIEF

The global merger control landscape continues to get more challenging. Driven by a perceived need to address underenforcement, regulators around the world are testing the limits of their jurisdiction and developing novel theories of harm. The results include longer regulatory timelines for complex, cross-border M&A and a greater potential for divergent outcomes at the end. A global merger control strategy that anticipates these challenges and seeks to mitigate them wherever possible has never been more vital.

![]()

Merger analysis is not a one-size-fits-all exercise. In different situations, different tools will shine the clearest light on a merger’s risk of harming competition.

Jonathan Kanter

Assistant Attorney General, US Department of Justice – September 2023

.

In detail

Jurisdictional uncertainty: authorities continue to widen the net

Flexible use of existing tools and new legislation has enabled agencies to review deals that may be of substantive interest, even where the basis for jurisdiction has not been clearly established.

- US: The Federal Trade Commission (FTC) and Department of Justice (DOJ) Antitrust Division have begun to investigate a broader scope of transactions. The revised DOJ and FTC merger guidelines (US Merger Guidelines), finalized in December 2023, give the agencies maximum flexibility to find potential anticompetitive harm and encourage aggressive enforcement (especially in relation to areas of perceived underenforcement such as roll-up acquisitions and mergers’ impact on labor markets). Proposed changes to the Hart-Scott-Rodino Act notification form and rules (HSR Form), if adopted, will increase the time, cost and burden on all businesses conducting M&A in the US.

![]()

The US Merger Guidelines are an unambiguous statement that the US antitrust authorities are committed to increased enforcement by clearly laying out an analytical framework for evaluating an array of traditional and non-traditional theories of harm and using new, lower or different thresholds than in the prior guidelines.

Meghan Rissmiller

Antitrust Partner, Washington, DC

- EU: Emboldened by the landmark Illumina/Grail case – a leading example of agencies forcing the unwinding of a merger on the basis of debatable legal theories – the European Commission (EC) has continued to apply its more expansionist approach towards the tool that allows it to accept requests from EU member states to review deals that do not meet either the EU’s or any member state’s national merger control thresholds (Article 22 referrals). Historically the EC has only accepted requests to review deals which met the thresholds for at least one member state. The recent Qualcomm/Autotalks and European Energy Exchange/Nasdaq Power transactions bring the number of Article 22 referrals that do not meet either EC or EU member state merger control thresholds since the EC issued revised guidance, with more possible in 2024. The EC looks set to expand the parameters on which businesses are deemed to compete, with a new Market Definition Notice. A merger control simplification package, adopted in April 2023, has reduced the administrative burden for some merging businesses but increased red tape for others, especially investors with large portfolios.

- EU member states: National competition authorities in Europe are also widening their reach. In Italy, new powers for the Italian Competition Authority have allowed it to “call in” transactions that are below mandatory filing thresholds. The German Federal Cartel Office (FCO) has recently investigated a number of completed foreign-to-foreign transactions – including Microsoft’s investment in OpenAI. Investigations have considered whether these transactions should have been notified under the German deal value threshold and, if so, whether they pose a competition problem that should lead to the merger being unwound. Furthermore, if a sector inquiry reveals that future mergers in the sector may lead to a significant impediment of effective competition, the FCO can now require a company in that sector to notify future transactions that meet certain lower thresholds than Germany's standard merger control thresholds. The Belgian and French authorities have investigated transactions under the EU rules that prohibit the abuse of a dominant position, even though they did not trigger any national thresholds for merger control review. The Court of Justice’s Towercast judgment validates the approach – authorities now have a tool that allows them to revisit transactions that do not meet merger thresholds long after they have closed.

- APAC: A mandatory and suspensory regime in Australia, a new transaction-value based filing threshold targeting so called “killer acquisitions” in India and updates to existing filing thresholds in China, Indonesia and Taiwan are all on the cards in 2024. New legislation in China has codified the ability of the State Administration for Market Regulation (SAMR) to review transactions that do not meet turnover thresholds, which existed before the new legislation but had rarely been used. SAMR has already flexed its power and imposed remedies on a below-threshold deal in the pharmaceutical industry. The enforcer’s boosted ability to review such transactions calls for a more robust filing analysis for dealmakers, particularly in tech markets – such as semiconductors – in which SAMR takes a keen interest.

- UK: The UK’s share of supply test continues to give the Competition and Markets Authority (CMA) significant discretion in deciding which transactions it wants to review. The Digital Markets, Competition and Consumers Bill, expected to come into effect in late 2024, will introduce an additional acquirer-focused jurisdictional threshold. The focus will be on vertical and conglomerate transactions but also so called “killer acquisitions”.

Novel theories of harm: regulators push the limits

Once they have claimed jurisdiction, authorities continue to explore non-traditional theories of harm, leaning heavily on a dynamic competition and innovation lens and turning up the heat on deals between parties that are not direct competitors (so-called non-horizontal deals). Developing theories – such as in the field of behavioral economics – are informing their approach. As authorities adopt more novel and speculative ways to assess horizontal, vertical and conglomerate relationships between merging parties, their concerns are becoming harder to predict and rebut with economic evidence.

- Strengthening/entrenching of a dominant position: Regulatory scrutiny of non-horizontal transactions reached new heights in 2023 with the EC’s prohibition of Booking/eTraveli. The EC ignored its own guidelines and discarded the conglomerate analytical framework that would have conventionally been applied to the deal; Olivier Guersent, (Director-General for Competition at the EC), later remarked, “If we were bound by our guidelines, then [we] would fossilize [our] practice… we need to have some capacity to depart from guidelines.” Instead, the EC undertook a blended analysis of both horizontal and non-horizontal aspects of the deal and blocked the transaction on the belief that the merger of the two complementary businesses would strengthen Booking’s alleged dominant position in the hotel online travel agency market.

The decision signals focus by the EC on deals in which it considers large companies are seeking to expand their existing suite of products and services through the acquisition of complementary assets. The approach is gathering momentum with other recent EC merger investigations examining whether a party’s dominant position in certain markets could be strengthened through the acquisition of a rival, even if that rival is not a strong player in those markets. US regulators look set to follow in the EC’s footsteps. The US Merger Guidelines, elucidate the expansive approach to enforcement that the US agencies have taken in the past three years. Among the notable guidelines is one that directs the US agencies to examine whether a transaction “entrench[es] or extend[s] a dominant position.”

![]()

The recent emergence of novel non-horizontal theories of harm around strengthening or entrenching a dominant position has demonstrated authorities’ willingness to stretch analytical boundaries and depart from established guidance, without any clear indication of limiting principles. Anticipating when and how these theories of harm might apply will be critical to deal execution.

Thomas McGrath

Antitrust Partner, London

- Ecosystems: Crucial to the Booking/eTraveli prohibition was the assertion that the transaction would allow Booking to expand its “ecosystem” of travel services. Tech ecosystems were also under the microscope in Microsoft/Activision (but, in contrast to the conglomerate nature of Booking/eTraveli, this time in a vertical context). The CMA deemed Microsoft’s product range a “multi-product ecosystem”, believing it to be greater than the sum of its parts, and dismissed Microsoft’s claims that its products were not integrated or linked and could not be used to “tip” the cloud gaming market in its favor. Regulators’ scrutiny of ecosystems is nascent, particularly in the merger control context. For example, SAMR used an ecosystem theory of harm to find Alibaba dominant in its landmark investigation against the e-commerce platform, but so far it has rarely referenced it in the merger control context. However, it is clear that firms should consider how a collection of products might fit into an authority’s conceptualization of an ecosystem.

![]()

In the realm of complex merger control enforcement, navigating novel theories of harm such as the rise of ecosystem theories requires a forward-looking analysis of dynamic competition. This underscores the importance of a nuanced global regulatory strategy early on.

Frank Montag

Antitrust Partner, Brussels

- Portfolio effects: In the US, the FTC sued to block Amgen’s acquisition of Horizon Therapeutics, a biopharmaceutical company with treatments for rare conditions. With no horizontal or vertical overlaps between the parties, the FTC alleged a novel portfolio effects theory that Amgen could leverage its own blockbuster drugs to insulate Horizon products from future competition. The FTC ultimately settled with the parties subject to conditions that prohibited the type of bundling the FTC alleged could cause harm (despite the parties having already committed not to bundle before the FTC challenged the deal). Arguably Amgen/Horizon is an outlier – many large pharmaceutical transactions continue to happen unhindered. However, the US Merger Guidelines are indicative of the DOJ’s and FTC’s persistent ambition, even in the face of high-profile losses, to investigate (and potentially challenge) a wider range of deals including a further focus on vertical transactions, mergers between potential competitors and mergers in a series of acquisitions.

![]()

The DOJ Antitrust Division and the FTC are pushing the boundaries of vigorous merger enforcement. US agencies are better funded and more aggressive than ever before – but most deals are still doable with careful planning and the right strategic approach to the regulators.

Mary Lehner

Antitrust Partner, Washington, DC

Deal certainty under pressure: timelines lengthen and divergent outcomes rise

Growing jurisdictional uncertainty and tougher substantive assessment have meant that review outcomes – and when parties can expect to receive them – are increasingly difficult to predict.

![]()

The new enforcement environment is causing merger counterparties to rethink their approach to substantive risk allocation: more reluctance to agree to ‘hell-or-high-water’ undertakings, greater reliance on reverse termination fees, and a greater willingness to agree to outside dates as long as 18-24 months, with an agreement to litigate if necessary.

Paul Tiger

Global Transactions Partner, New York

- Timelines: Authorities’ increasing use of information requests and stop-the-clocks as they more closely scrutinize transactions is extending review timelines and challenging traditional long stop date projections. The leading example in 2023 was Intel/Tower – the deal was abandoned after 18 months, following lengthy review in China with uncertainty over when regulatory approval might be given. SAMR has often been the long pole to approve global deals despite greenlights from other major authorities, forcing merging parties to extend long stop dates to secure clearance or abandon deals altogether. Proposed revisions to the HSR Form would require production of significantly more information and ordinary-course documents at the time of filing, which extends the timeline before agency review begins and underscores the need for advanced preparation.

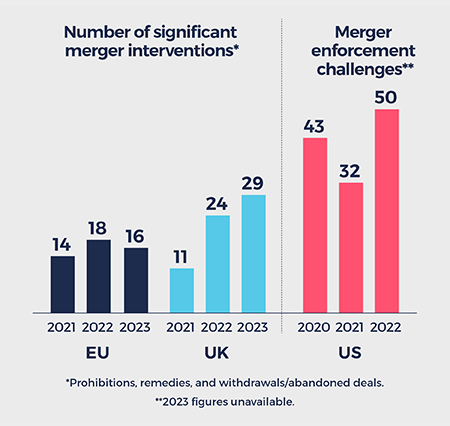

- Divergence: Authorities’ historical efforts to reach consistent outcomes on deals, absent compelling local differences in competitive conditions, are fading. Authorities’ willingness to explore non-traditional theories of harm, coupled with the growing number of significant merger interventions, is driving divergent outcomes for global mergers as regulators identify and assess competition concerns in different ways.

The divergent trend set by Google/FitBit and Konecranes/Cargotec was followed in 2023. Most notable was Microsoft/Activision. While SAMR gave the green light to the transaction after a series of thorough market tests, the EC cleared the transaction subject to licensing remedies. The CMA blocked the transaction but, in an unprecedented development, allowed Microsoft to submit a restructured transaction for review and cleared it on the basis of a fix-it-first remedy. At the time of publication, the FTC continues to oppose the transaction in federal court and its own administrative proceeding, despite having lost in July 2023 its motion for preliminary injunction to stop the deal from closing, which is now on appeal.

Looking ahead in 2024

- Mitigate decreasing deal certainty through innovative drafting of deal documents. Provide for a broader range of competition review outcomes – both jurisdictionally and substantively – in transaction documents through conditionality, risk allocation and long stops.

- Prepare for increasing application of “strengthening of dominant position” theory by regulators. Anticipate use of the theory by major enforcers (and others) in transactions involving a dominant market player and push for alignment in analytical framework across regulators. Search for limiting principles that can be applied to transactions and distinguishing factors from current precedents.

- Consider potential remedies early on. Remedies are increasingly common in regulatory reviews. Minimize regulatory risk by identifying workable and commercially acceptable remedies, assessing how they interact in the context of multiple parallel reviews, and potentially offering them up proactively to regulators where appropriate. But assess whether merger control remedies undercut other reviews – such as foreign direct investment – or negatively impact their timeline.

![]()

Advance planning is key. Well before signing, parties must assess the jurisdiction-specific level of interest in a deal and scope out competitive, geopolitical and industrial policy issues that could affect a decision. Despite these headwinds, deals can still get done with careful substantive and procedural planning.

Hazel Yin

Antitrust Partner, RuiMin Law Firm, China*

With thanks to Milo Noone, Emily Abbott, Tuna Tanik and Wenting Ge for their contributions to this theme.

*RuiMin is an independent PRC law firm that is part of our global StrongerTogether Network.

- Introduction

- 01. Taking center stage global antitrust for the mid-2020s

- 02. Merger enforcement the path to clearance gets even tougher

- 03. Investing across borders in 2024 – strengthened controls to protect domestic capabilities

- 04. Digital markets antitrust and artificial intelligence – the next frontier?

- 05. Consumer driven enforcement consumer facing businesses in the regulatory spotlight

- 06. In focus: life sciences and pharma – conduct and commercial practices under the microscope

- 07. Antitrust and sustainability will 2024 bring regulatory alignment or will the chilling effect of uncertainty persist?

- 08. Dominance and monopolization back to the future?

- 09. Antitrust investigations uptick in enforcement with tougher powers and increased interagency cooperation

- 10. Cross-border claimant strategies – focused on investigations and litigation

- Download the full report

Authors

Mary Lehner Partner

Washington, DC

Thomas McGrath Partner

London, Brussels

Dr. Frank Montag Partner

Brussels

Meghan Rissmiller Partner

Washington, DC