Global Antitrust in 2024: 10 key themes

Investing across borders in 2024 – strengthened controls to protect domestic capabilities

IN BRIEF

With no sign of geopolitical tensions between leading Western economies and China and Russia abating, and with other tensions emerging, governments are sustaining the trend of deglobalization and tending toward a more economically self-sufficient approach. The pattern looks set to continue in 2024. Governments are likely to push forward agendas to invest in domestic critical capabilities while simultaneously pursuing the tougher application and expansion of existing foreign investment controls and introducing other review mechanisms. Inevitably, this shift will impact how dealmakers assess potential transactions – including execution risk, cost and timelines.

.

In detail

Policymakers are devising “run faster” strategies to invest in and expand domestic critical capabilities

Driven by historic high reliance on foreign actors – particularly for critical resources, infrastructure and technologies – governments are devising policies to develop (or restore) self-sufficiency and competitiveness in sensitive homegrown industries. The US Inflation Reduction Act and the CHIPS and Science Act have marked the way in improving capabilities in semiconductors and sustainable energy. The European Commission (EC) has introduced similar measures, including the European Chips Act and the Green Deal Industrial Plan, and looked to protect yet more sectors with the Critical Raw Materials Act. The UK’s National Semiconductor Strategy and Energy Security Plan are indicative of how more countries will follow the US’s and the EU’s lead. Subsidies for domestic companies in these sensitive areas are proliferating at the same time as public administrations are becoming more cautious of foreign investors. Detailed assessment of sources of financing is now crucial to ensure smooth execution of projects.

![]()

Government interventions pushing the Green Transition are becoming more frequent, particularly in Europe. We can help turn this push into opportunities for our clients by identifying funding sources for projects and securing regulatory approvals.

Andreas von Bonin

Antitrust Partner, Brussels

Governments are intensifying FDI screening across a broader set of investors and businesses to protect sensitive sectors

Trends in inbound foreign direct investment (FDI) screening have echoed the economic development priorities behind the expanding investment in domestic critical capabilities.

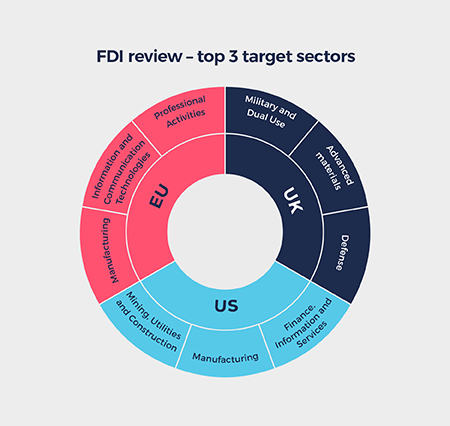

- Sectors: Many of the sectors facing intense scrutiny are comparable across the Western hemisphere. The Committee on Foreign Investment in the United States (CFIUS) annual report shows that in 2022 most notices were filed in the Finance, Information and Services and Manufacturing sectors. The EC’s 2023 EU FDI Screening Regulation report tells a similar story: transactions in the Manufacturing and Information and Communication Technologies sectors were most likely to be subject to an in-depth review. In the UK, the majority of 2022-2023 transactions resulting in blocks or remedies were in related sectors – Communications Technology, Computing Hardware and Advanced Materials – but also Energy, Defense and Military/Dual-use. In Japan, cybersecurity deals (including data processing, semiconductors and software transactions) accounted for 61 percent of notifiable stock acquisitions.

![]()

Although the US’ reputation as the premier source and destination of foreign direct investment is firmly grounded, the US government continues to take opportunities to secure its critical capabilities where necessary. Other countries are also likely to continue to intensify their efforts as they race to make sure that their critical assets and capabilities are not left vulnerable to foreign takeover.

Aimen Mir

CFIUS Partner, Washington, DC

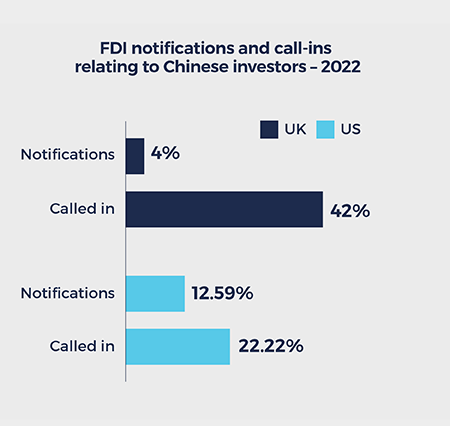

- Investors: Unsurprisingly, given geopolitical fault lines, investors linked either directly or indirectly to China are subject to the most rigorous examination when it comes to FDI reviews (Russian investment has been broadly blocked by sanctions). Under the UK FDI regime, Chinese investors made up approximately 4 percent of overall notifications but comprised 42 percent of those subject to in-depth reviews, and approximately 50 percent of those were subject to remedies. In Japan, the number of Chinese notifications doubled between 2021 and 2022, with the Japanese government reportedly in close dialogue with US authorities when reviewing some cases. Although the volume of Chinese notifications has decreased, investors in the EU and the US with links to China (even if distant) have faced increased scrutiny, including longer reviews and greater risk of remedies. For example, Japanese investors have become subject to intensifying scrutiny due to their links to China, including deep supply chains, revenue dependency and targeting by China of Japanese tech. Similarly, Singapore has become more of a focus because many Chinese companies have redomiciled to Singapore, in part to hedge against geopolitical risk.

![]()

Japanese companies are long-standing and trusted investors in the West but often have significant business interests in China. As scrutiny of Chinese-linked investment grows, Japanese investors can also expect to face more scrutiny where previously they may have had an easier ride.

Kaori Yamada

Antitrust Partner, Tokyo

Businesses must ensure that they analyze FDI risk as part of a holistic regulatory assessment. A synced approach between merger control and FDI is especially crucial. For example, the tension between offering domestic supply commitments in semiconductor mergers in China and respecting broader US export control rules limiting China’s chip access raises concerns about the ability of US firms to meet stipulated conditions in Chinese merger decisions.

New and amended regimes are being introduced to counter perceived threats to national security and fair competition

A decade ago, many jurisdictions did not have FDI regimes. Now, traditional FDI regimes are no longer deemed as sufficient protection from the new generation of perceived threats to national security. The European system of FDI screening will likely see a further tightening of the net. In December 2023, the EU Court of Auditors recommended that the EU screening system be reformed to avoid “blind spots” and called for increased cohesion of the system and cooperation between the EC and the member states’ FDI authorities. The number of interventions in Europe continues to be high, at least in certain key jurisdictions.

For example, of 325 FDI applications filed in France in 2022, 70 transactions were only authorized subject to conditions – a figure proportionally higher than in merger control under the competition regimes.

![]()

Governments are multiplying and refining their tools to protect their economies against unfair competition and national security threats. Investors need to factor in the onerous and potentially unpredictable impact of the resulting multifaceted reviews to prevent deals being derailed.

Alastair Mordaunt

Antitrust Partner, London/Hong Kong

Omissions that were considered inconsequential have gained new significance with the evolution of the global geopolitical landscape, and governments are now introducing new regimes to fill the gaps.

- Outbound investment: Outbound investment screening (OIS) regimes are likely to become more widespread in the coming months as they (i) provide control over strategic investments abroad, particularly in hostile states; (ii) counter the risk that investors may aid the development of sensitive technologies in those hostile states; and (iii) address offshoring of critical capabilities and the resulting reliance on other countries. The US, the EU and the UK are following suit, since China, Japan, South Korea and Taiwan already have OIS regimes. In August 2023, President Biden issued Executive Order 14105 directing the Department of the Treasury to establish an outbound FDI regime regulating certain US investments in “countries of concern” – for now, only China – which is likely to come into force sometime in 2024. The EC is likely to issue its proposal, together with its suggested revisions to the EU FDI Screening Regulation, in 2024, together with its suggested revisions to the EU FDI Screening Regulation. The UK government is also currently reviewing whether, and if so how, it should strengthen its outbound investment controls.

- Foreign subsidies: There are growing perceptions that unfair competition exists between homegrown competition and foreign (subsidized) competition. In particular, governments are concerned that unfairly subsidized foreign competition could undermine (and potentially eliminate) domestic competitors, especially in sensitive sectors. The EU’s Foreign Subsidies Regulation (FSR) – which became fully effective in October 2023 – has been introduced to tackle this issue. The FSR establishes a mandatory and suspensory obligation on parties meeting certain thresholds to notify the EC of foreign subsidies received from non-EU states (including the US and the UK), which may impair competition within the internal market. Similarly, in the US, the Federal Trade Commission has proposed numerous amendments to the Hart-Scott-Rodino (HSR) Act notification form including an obligation on transaction parties to identify and describe subsidies received (or anticipated to be received) from a “foreign entity or government of concern” (i.e., countries or entities that are strategic or economic threats to the US). This amendment addresses congressional concerns that subsidies from such entities can distort the competitive process or otherwise change the business strategies of subsidized firms in ways that undermine competition following an acquisition.

![]()

More than ever, investing in sensitive areas requires a holistic approach to regulatory approvals. Given the flurry of new FDI and subsidies filing requirements, there is an increased risk of conflicting outcomes and remedies. From the start of the M&A process, companies will need to have a strategy to actively manage this risk. In particular, remedies in one country will need to also take into account other regulators’ views.

Frank Röhling

Antitrust Partner, Berlin

![]()

There is now a wall of regulatory processes that must be mastered in any multi-jurisdictional transaction. Dealmakers should realize that for many new regimes clear guidance from authorities is sparse. As a consequence, deal security and deal speed are more unpredictable, creating a need for finely balanced deal documentation to hedge the uncertainty.

Barbara Keil

Global Transactions Partner, Munich

Looking ahead in 2024

In an increasingly unpredictable and multifarious regulatory environment, dealmakers need to:

- Monitor the evolving regulatory landscape and design deal structures (and documents) accordingly. Dealmakers will need to be informed of amendments in 2024 to existing regimes (HSR, EU FDI Screening Regulation and the UK National Security & Investment Act 2021) and potential introduction of new ones (e.g., new national FDI regimes in the EU and OIS regimes in the EU and the UK). A comprehensive understanding of these regimes and the underlying policy drivers will enable dealmakers to navigate them effectively and efficiently, minimizing execution risk.

- Be prepared for multidimensional scrutiny and onerous information collection requirements. As reviews intensify and the number and types of regimes continue to increase, so will the competing information gathering obligations on transaction parties. Preparing for these requests in advance, particularly for regimes such as the FSR, will make the review processes smoother and shorter while also enabling parties to assess deal risk early and accurately.

- Prepare for increasing interference of governments and public bodies in markets. At the same time as countries are protecting their markets from certain types of foreign investment via FSR and FDI regimes, there is a broad trend of governments stepping onto the scene with large-scale funding programs and interventions to push economic transitions. Deal and investment planning needs to take this into account, both as a risk factor and as an opportunity.

With thanks to Iona Crawford, Justyna Smela, Edward Dean and Tim Swartz for their contributions to this theme.

- Introduction

- 01. Taking center stage global antitrust for the mid-2020s

- 02. Merger enforcement the path to clearance gets even tougher

- 03. Investing across borders in 2024 – strengthened controls to protect domestic capabilities

- 04. Digital markets antitrust and artificial intelligence – the next frontier?

- 05. Consumer driven enforcement consumer facing businesses in the regulatory spotlight

- 06. In focus: life sciences and pharma – conduct and commercial practices under the microscope

- 07. Antitrust and sustainability will 2024 bring regulatory alignment or will the chilling effect of uncertainty persist?

- 08. Dominance and monopolization back to the future?

- 09. Antitrust investigations uptick in enforcement with tougher powers and increased interagency cooperation

- 10. Cross-border claimant strategies – focused on investigations and litigation

- Download the full report

Authors

Dr. Andreas von Bonin Partner

Brussels

Dr. Barbara Keil Partner

Munich

Aimen Mir Partner | Foreign Investment and National Security | Head of CFIUS Practice

Washington, DC

Alastair Mordaunt Partner

London, Hong Kong

Dr. Frank Röhling Partner

Berlin

Kaori Yamada Partner

Tokyo