Global Antitrust in 2024: 10 key themes

Taking center stage

global antitrust for the mid-2020s

IN BRIEF

Antitrust is evolving. Geopolitical tensions, market volatility, inflation, trade realignment and supply chain issues are intensifying economic complexity worldwide. As the role and scope of antitrust law and policy develop to meet these challenges, so too do the tools of competition authorities and the courts.

There is broad consensus among authorities that they can be part of the solution by promoting competitive markets, protecting consumers and supporting productivity, innovation and growth. But the ways and means by which different authorities are pursuing those goals show signs of divergence. The effect of such enforcement and evolving regulatory challenges on the cost, certainty and timing of global business should not be underestimated. Businesses need to be aware of, and prepare for, the myriad changes taking place now and down the line.

![]()

The remit of antitrust authorities is expanding. New regulation, theories of harm and enforcement priorities are indicative of a belief that global economic structures are broken and that more assertive regulators are part of the solution.

Thomas Janssens

Antitrust Partner, Brussels

.

In detail

Authorities are more likely to investigate mergers and challenge them in unconventional ways

Authorities appear to have a mandate from elected officials to resist further concentration in certain markets and to correct perceived past underenforcement in merger review. Regulatory toolkits and appetites to consider novel or resuscitated theories of harm are expanding to match this ambition. In 2024, across many jurisdictions, the net for notifiable deals will widen and new processes will introduce more stringent notification requirements for M&A transactions (see Theme 2).

Beyond competition risks, rising geopolitical tensions between Western economies and Russia and China have added a layer of complexity to authorities’ scrutiny of transactions. The trend toward deglobalization is unfolding through the tougher application and expansion of existing foreign direct investment (FDI) regimes, as well as the introduction of new ones. The introduction of the EU Foreign Subsidies Regulation in 2023, investigating deals where companies involved have received subsidies granted by non-EU countries, has established a third dimension of review in Europe (see Theme 3).

For deals caught by review thresholds, scrutiny by authorities will become more complex. As they react to fast-changing markets, agencies are stretching orthodox concepts and introducing novel theories of when a deal is likely to harm competition, threaten national security or give an unfair advantage to foreign (subsidized) businesses over homegrown players. The end effect will likely be increasing intervention in M&A activity in major jurisdictions resulting in longer review periods and increased execution risk and cost.

![]()

Given the uncertainty in the current regulatory environment, early antitrust assessment is critical to anticipating global review timelines and outcomes. An early assessment can inform transaction negotiations and antitrust strategy, including the possibility of litigation in the US.

Jamillia Ferris

Antitrust Partner, Washington, DC

Governments look to new regulatory approaches to police certain markets

![]()

A key question is not whether government shapes markets, but how government shapes markets and towards what ends.

Lina Khan

Chair, US Federal Trade Commission - November 2023

Digital and consumer markets are at the top of the enforcement agenda. 2023 saw the groundwork being laid for a host of new laws set to bite in 2024 that will give authorities the ability to proactively shape these sectors.

The EU-wide Digital Markets Act will move to its final compliance and enforcement phase in 2024 for designated gatekeepers. In the UK, the Digital Markets, Competition and Consumers Bill (DMCC Bill) – set to be fully in force in late 2024 – is intended to improve the effectiveness of the existing UK competition law regime in dealing with concerns arising in digital markets and the tech sector, particularly in response to the alleged market dominance of a few players. Outside Europe, the movement toward digital regulation continues to gain momentum. In May 2023, a bill proposing the Federal Digital Platform Commission Act was introduced in US Congress. If the bill is enacted, a new commission would be established that could designate undertakings as systematically important digital platforms. A new regime in Japan has provided the government with an expanded remit to “secure fairness in operating digital platforms” and India looks set to gain an ex ante regulatory regime with the proposed Digital Competition Act. Authorities will step up efforts in identifying and preempting anticompetitive harm in artificial intelligence-focused markets while also attempting to foster competition and innovation (see Theme 4).

![]()

Enforcers in the Asia-Pacific region continue to attract attention, and while approaches may differ in terms of enforcement intensity, levels of fines and priorities, there is emerging consensus among antitrust authorities around regulating digital markets.

Ninette Dodoo

Antitrust Partner, Beijing

Countering cost-of-living challenges, protecting vulnerable consumers and cracking down on unfair commercial practices are also at the forefront of antitrust agencies’ priorities. In 2024, the Federal Trade Commission (FTC) is expected to ramp up investigations and enforcement actions focused on consumer protection by leveraging an expanded interpretation of “unfair methods of competition”. The DMCC Bill will significantly expand enforcement of UK consumer protection laws by the Competition and Markets Authority, allowing the authority (rather than the courts) to determine directly whether consumer laws have been breached and, if appropriate, impose penalties. The European Commission’s “New Consumer Agenda” continues to drive regulatory changes across Europe. 2023 saw the INFORM Consumers Act take effect in the US, putting new requirements in place for online marketplace to boost transparency and deter illicit sales (see Theme 5).

![]()

Spurred by governments that increasingly regard antitrust enforcement as a way to unlock growth and counter economic uncertainty, enforcers are looking to get ahead of potential harms – not react to them.

James Aitken

Antitrust Partner, London

Antitrust enforcement set to rise

Authorities have been quick to confirm that new regulatory regimes will not temper ex post antitrust enforcement. If anything, the signs are that enforcement will continue with renewed vigor (see Theme 9).

As the European Commission’s recent investigations into large technology businesses show, there is still an appetite to tackle difficult dominance cases and investigate digital markets with conventional tools. An emerging challenge is the increasingly sophisticated cross-border strategies that claimants are deploying for related antitrust litigation (see Theme 10).

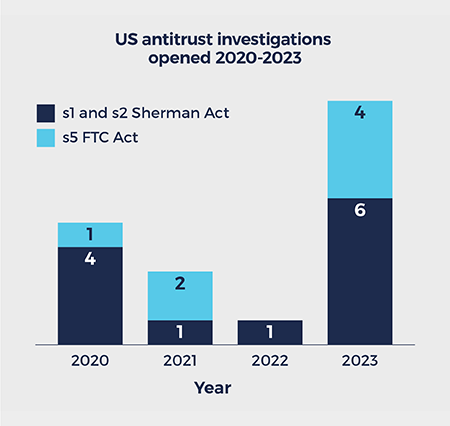

The US Department of Justice Antitrust Division and the FTC look set to continue their recent push to slow consolidation and counter what they view as anticompetitive business conduct. High-profile cases against some of the world’s largest technology companies will progress; the FTC’s “unfair practices” cases against Amazon and US Anesthesia Partners are set to further advance their enforcement agenda (see Theme 8).

While the supply shocks of the pandemic have passed, inflated prices and high rates of businesses exiting markets remain. Enforcers have pointed to their antitrust toolkit as a key way to examine whether these hangover effects are due to market characteristics or less legitimate reasons. For example, a number of Asian enforcers have scrutinized household goods and food delivery sectors as part of a wider push to focus on the cost of living. Reinvigorated cartel enforcement is key to these efforts: the return to physical (and virtual) dawn raids following a COVID-induced hiatus continued in 2023, with the added surprise of an increased willingness to raid private homes in the work-from-home environment.

With authorities keen to play their part facilitating competitor collaborations to promote green initiatives, new horizontal guidelines will allow sectors and companies to cooperate to find more sustainable solutions. However, regulators have made clear that environmental, social and governance initiatives cannot be used as cover for anticompetitive behavior and will look to crackdown on “greenwashing” (see Theme 7).

Looking ahead in 2024

- Proactively prepare for regulatory changes. A shifting regulatory landscape means proactive planning and preparation are crucial. Businesses need to creatively anticipate and address potential issues, be it in M&A negotiations or defending against antitrust investigations. Staying ahead of the curve through strategic planning is essential.

- Engage with global authorities. As regulators (on the whole) become more globally connected and cooperative, businesses must engage on an international scale. Ensuring consistent communication and messaging to agencies worldwide is vital. Whether navigating cross-border M&A or responding to antitrust challenges, businesses should be prepared to present a unified front.

- Issue-spot authorities’ evidence base early on. Strong economic evidence using sophisticated analytical tools can buttress arguments for the benefits of a transaction or a business’s conduct on competition. But authorities are increasingly basing negative decisions on internal documents (focusing on a “story” rather than on quantitative data). Rigorously engage with competitors’ and customers’ perceptions of a transaction or conduct and ensure internal documents accurately reflect rationale.

With thanks to Milo Noone, Kara King and Charles Tay for their contributions to this theme.

- Introduction

- 01. Taking center stage global antitrust for the mid-2020s

- 02. Merger enforcement the path to clearance gets even tougher

- 03. Investing across borders in 2024 – strengthened controls to protect domestic capabilities

- 04. Digital markets antitrust and artificial intelligence – the next frontier?

- 05. Consumer driven enforcement consumer facing businesses in the regulatory spotlight

- 06. In focus: life sciences and pharma – conduct and commercial practices under the microscope

- 07. Antitrust and sustainability will 2024 bring regulatory alignment or will the chilling effect of uncertainty persist?

- 08. Dominance and monopolization back to the future?

- 09. Antitrust investigations uptick in enforcement with tougher powers and increased interagency cooperation

- 10. Cross-border claimant strategies – focused on investigations and litigation

- Download the full report

Authors

-

James Aitken Partner, Head of London Antitrust, Competition and Trade Group

London, Dublin

-

Ninette Dodoo Partner

Hong Kong

-

Thomas Janssens Partner

Brussels