In 2025, investment claims are likely to be shaped by major geopolitical shifts that have developed in recent years. Most noteworthy are the new administrations in Mexico and the US, the fate of the war in Ukraine and China’s trade and foreign investment policies. Investors who may be exposed to adverse action in connection with these developments should review their corporate structures and take necessary action to ensure that their investments are protected by investment treaties.

By Noiana Marigo, Lee Rovinescu, Xin Liu and Gregorio Pettazzi

Last year, Mexico saw record levels of foreign investment, mainly due to its position as the best nearshoring option in the region. Investors appear to have been comforted by checks and balances in the Mexican legal system that prevented former President Andrés Manuel López Obrador (AMLO) from taking sweeping action against foreign investment that had been anticipated earlier in his administration. While the nearshoring trend is likely here to stay, the country’s investment climate has become more complicated due to a series of controversial reforms introduced by Mexico’s new President, Claudia Sheinbaum, along with the Trump administration’s increasingly aggressive stance towards Mexico, including the recent imposition of a 25 percent tariff on Mexican imports.

At the forefront of the Sheinbaum administration’s reforms is the overhaul of the Mexican judiciary, imposing popular elections for all federal judges, including Supreme Court justices. In addition, a number of independent regulators have been abolished. Experts see these reforms as a threat to the rule of law and an attempt to concentrate power in the executive branch. Sheinbaum has targeted key productive industries, such as the energy sector, increasing the dominance of state-owned players, and the mining sector, seeking to ban open-pit mining.

![]() 2025 is shaping up to be a pivotal year for Mexico, especially in light of the new reforms sponsored by the Sheinbaum administration. Moreover, the next few months will be crucial in shaping the future of trade relations between Mexico, Canada, and the US.

2025 is shaping up to be a pivotal year for Mexico, especially in light of the new reforms sponsored by the Sheinbaum administration. Moreover, the next few months will be crucial in shaping the future of trade relations between Mexico, Canada, and the US.

Noiana Marigo

Partner

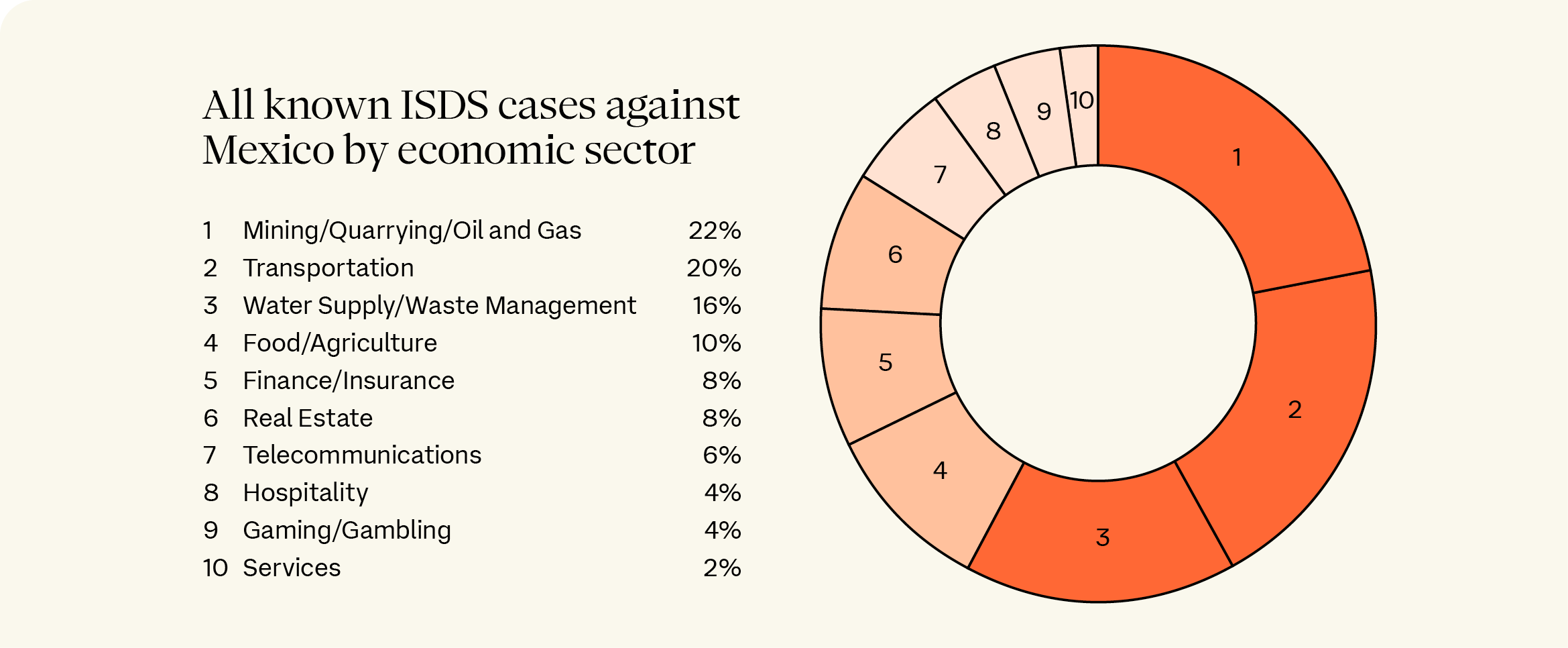

These structural changes are likely to be a significant driver of future investment claims against Mexico. In this context, investor-state dispute settlement (ISDS) remains the safest mechanism to protect foreign investments in the country, especially given the increased uncertainty of the effectiveness of domestic remedies following the judicial reform. Historically, Mexico has a reassuring track record when it comes to compliance with adverse investment treaty awards.

We anticipate a highly volatile investment landscape due to these significant geopolitical shifts. We recommend any investor operating in these regions to consider the following practical steps:

-

Assess investment protection frameworks: carefully evaluate the applicable investment protection treaties available in the jurisdiction in which your investments are located to ensure that they are adequately safeguarded.

-

Evaluate if restructuring is necessary: if current protections are insufficient, take swift action to restructure investments to ensure access to ISDS mechanisms. Proper structuring before a dispute arises is crucial for securing ISDS protection.

-

Monitor legal developments: closely monitor any legal developments and investor-related measures, as aggressive actions may be taken quickly with little to no warning in the current geopolitical climate. Timely challenges to these measures can be critical in an eventual dispute.

Our team of global ISDS specialists brings expertise across these regions, helping businesses navigate and safeguard their interests in today's increasingly complex geopolitical landscape.

If you'd like to discuss any of these topics in more detail, or anything else, your Freshfields contact would be glad to assist.

International arbitration in 2025

Contacts