We anticipate an increase in disputes arising from deals in the private capital space. The significant backlog of failed exits from deals signed in recent years is driving more investors to arbitration to resolve -related disputes. Additionally, the growth of "secondaries" as alternatives to traditional M&A and IPO exits is leading to a new class of disputes. Arbitration remains the preferred tool for private capital institutions to resolve post-M&A disputes. Private capital investors are also increasingly leveraging arbitration against state governments under investment treaties to address adverse legislative, regulatory or other actions taken by host governments.

By John Choong, Oliver Marsden, Patrick Schroeder, Samantha Tan, Thomas Walsh and Niklas Wong

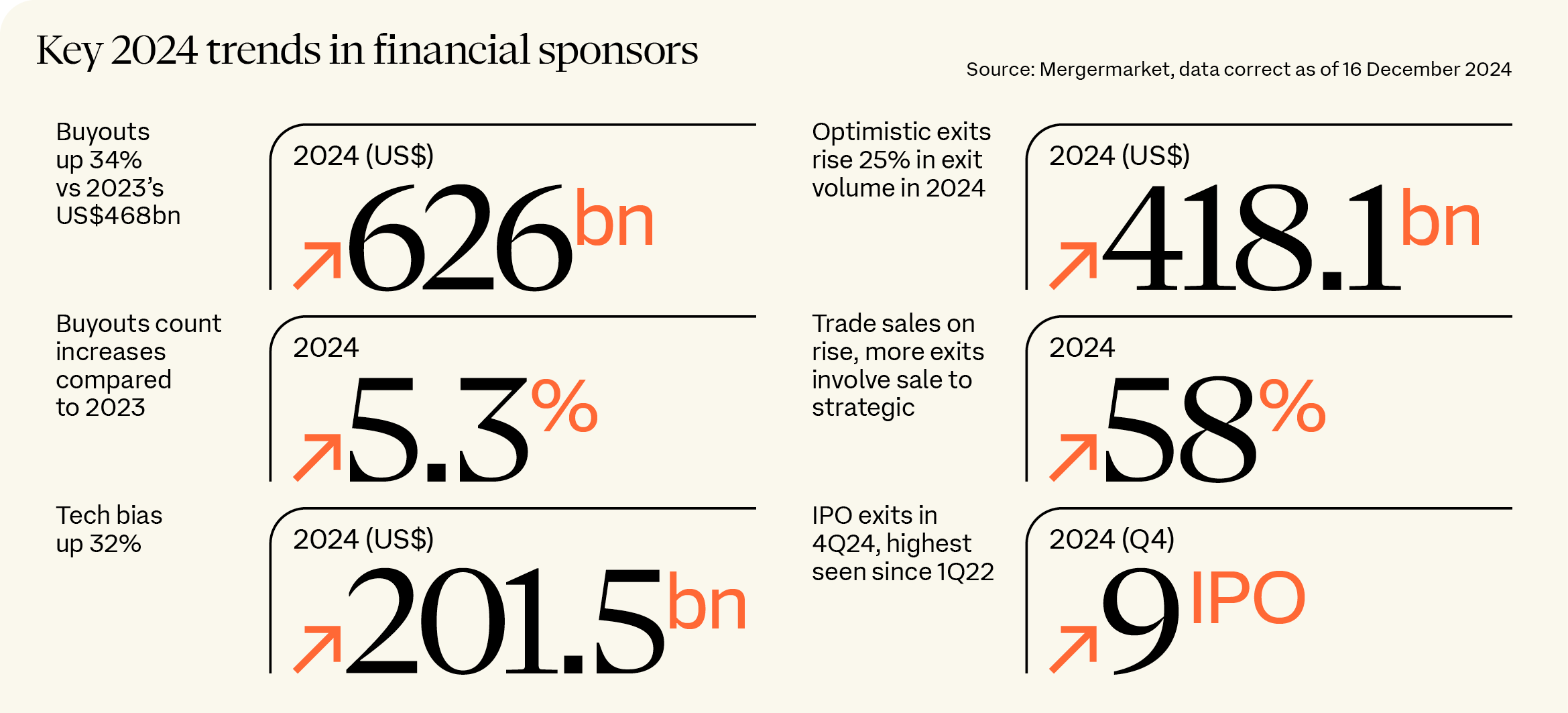

The macroeconomic outlook for 2025 is cautiously optimistic for dealmakers, tempered by ongoing uncertainty and volatility. With inflation largely coming under control and interest rates trending downwards, market sentiment is increasingly positive, fueling greater interest in deal-making. Financial sponsors, holding trillions of US dollars in dry powder and under pressure to strike deals, along with high US-listed public asset valuations, are expected to drive continued interest in alternative assets from institutional and sovereign wealth funds. As Freshfields’ Co-Head of US Corporate and M&A, Ethan Klingsberg, observes in his M&A Predictions and Guidance for 2025, fund-level transactions in expanding secondary markets are here to stay in 2025. Private credit is also not going away, as investors seek additional avenues to enhance returns in a lower interest rate environment. Of course, it remains to be seen how the tide may turn with the new administration in the US.

Arbitration remains a leading dispute resolution forum for private capital disputes. Arbitrations are frequently subject to terms of confidentiality, which minimizes the risk of negative publicity from disputes. Party autonomy in arbitration also affords greater control over procedure and timelines compared to court proceedings in many jurisdictions and the lack of appeal rights on the merits in arbitration enables parties to get to a final resolution more quickly, which is crucial for funds with short exit timeframes. Investors also value arbitration’s ability to allow them to select decision-makers with relevant expertise.

Many private capital disputes are highly fact-sensitive. Therefore, from the outset of any potentially contentious matter, it is crucial for parties to handle written documents carefully, ensuring that a proper paper trail is put in place to support their factual position in future proceedings.

When structuring new transactions, investors should consider the availability of investment treaty protections based on the investment vehicle’s country of incorporation and the host country of the target company. These protections can offer an additional layer of security, depending on the region, nature of the investment, and industry sector.

Additionally, investors should seek to ensure that they have effective recourse for any claim, either through security (e.g., a tranched payment structure for the purchase consideration, or using an escrow mechanism), or available assets for enforcement in countries party to the New York Convention (the convention governing the cross-border enforcement of arbitral awards).

Our arbitration specialists have extensive experience in advising private capital clients on their disputes all over the world. Reach out to us to discuss the latest trends and their potential impact on your business.

International arbitration in 2025

Contacts