Competition litigation in the UK

Mastercard

Staving off a huge potential class action

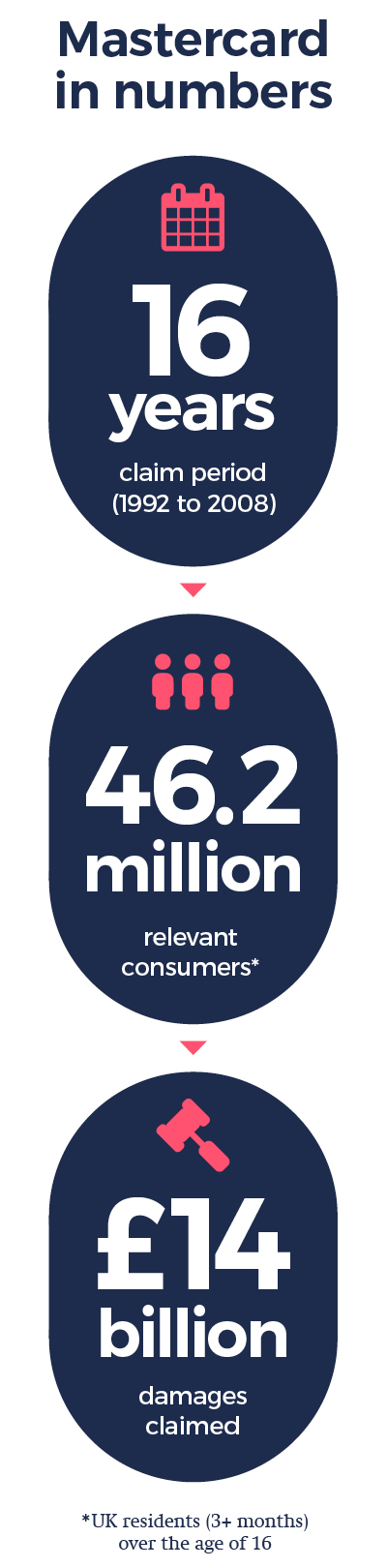

When Mastercard faced a potential consumer class action brought on behalf of over 46 million consumers for claimed damages in excess of £14bn, the credit card company turned to our market-leading competition litigation team for help.

The proposed action against Mastercard concerned allegedly inflated 'multilateral interchange fees' charged between Mastercard and banks, and passed on to merchants, for providing card acceptance services in stores.

The claim, which sought to follow on from an infringement decision against Mastercard by the European Commission, was brought on behalf of individuals who, during a period of over 16 years, bought goods or services from merchants in the UK that accepted Mastercard, even if the card was not used in the purchase.

The claimants' application for certification to the UK's Competition Appeal Tribunal (CAT) sought to launch the first major opt-out action under the new collective proceedings regime introduced by the UK's Consumer Rights Act 2015. It would have reportedly been the largest damages claim ever brought in the UK.

The claim was reportedly the largest damages claim ever brought in the UK.

Building a compelling case

The decision the CAT had to make was whether to certify the application and let the case go forward as an opt-out class action on behalf of all UK consumers within the proposed class (other than any who decided to opt out). As Mastercard faced an enormous claim, with so much at stake, it was crucial to advance solid reasons why the CAT should not certify.

The proceedings were not only complex but also involved a brand new type of litigation in the UK, with no existing precedents. We identified overlaps and synergies with other claims brought against Mastercard by the merchants. We also leveraged the expertise of Mastercard's barrister team, its in-house lawyers and other international counsel in jurisdictions with established class action regimes.

We used the expertise of Mastercard’s barrister team, in-house lawyers and international counsel, plus our own experience of mass tort claims in other fields.

We also drew on our experience of defending large mass tort claims in other fields, such as environmental and product liability actions. This enabled us efficiently to build a convincing case against certification.

The CAT's judgment gives clarity

In its July 2017 judgment (PDF, 489KB), the CAT turned down the application to certify the proceedings, accepting Mastercard’s arguments that the claims were not suitable to be brought collectively.

The CAT's judgment has given some clarity to the criteria to be satisfied and the evidence required by the CAT to certify collective actions.

Our work with Mastercard's lawyers in the US, Canada and Australia, which have established class action regimes, proved crucial, particularly as the CAT ruled that the Canadian approach to the standard of expert evidence required to certify a collective action is to be followed in UK collective proceedings.

Our work with Mastercard’s lawyers in Canada proved crucial as the CAT ruled that the Canadian approach to assessing expert evidence should be followed in the UK.

Further legal proceedings

On 16 April 2019, the Court of Appeal handed down a judgment setting aside the July 2017 ruling and remitting it to the CAT for a further certification hearing. The Supreme Court has agreed to hear Mastercard’s appeal against the Court of Appeal’s ruling.

The case continues a long list of matters Freshfields has worked on that have driven the development of the law relating to competition damages actions in the UK. Indeed, the matter won the award for litigation of the year in the non-cartel defence category at the Global Competition Review awards 2018.

How we helped

Our team

Nicholas Frey Partner

London

Jonathan Isted Partner

London

Mark Sansom London and Dublin Managing Partner

London, Dublin

Ricky Versteeg Partner

London, Brussels

Simon Duncombe Partner

London