Briefing

How does ESG impact M&A?

ESG (Environment, Social, Governance) is driving businesses globally to re-think, re-calibrate and sometimes even re-invent their business models. In many cases, the results of these thought processes include M&A. Think of disrupted industries, unsustainable business models, supply chain issues requiring mergers, acquisitions, joint ventures, or divestitures to future-prove a company.

Even beyond such sustainability-driven M&A, ESG’s impact on the global M&A market is widespread. Buyers of any kind of business need to make sure they are not acquiring toxic operations undermining their ESG policies and ambition. Ensuring this requires modifications to two principal areas of M&A: the due diligence review of the target business and the transaction documents governing the deal.

1. Due Diligence

1.1 Drivers of ESG due diligence

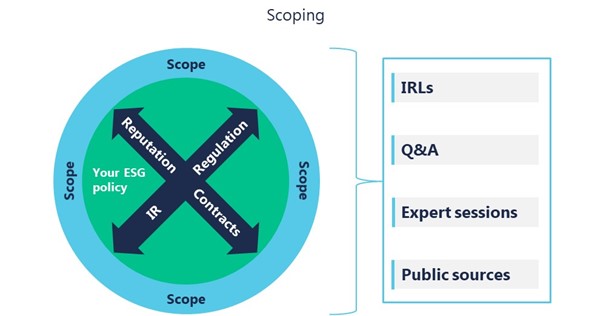

ESG expands and modifies both the scoping and reporting of M&A due diligence. Similar to ordinary-course due diligence of supply chains, various aspects drive the ESG-related scoping of the M&A due diligence exercise as illustrated by this chart.

Regulation. The most important driver will be regulation. Most new or upcoming legislation focuses on the operational (e.g., supply chain) due diligence. But any such new regulatory requirements will indirectly also impact the due diligence of an M&A target and its supply chain.

Contractual obligations. Customers and suppliers may have imposed contractual (or actual) obligations on the buyer to be “ESG-compliant” and therefore, directly or indirectly, require the buyer to make sure that any acquired business in turn complies with these ESG criteria. Think of a tier 1 automotive supplier buying a tier 2 supplier. The tier 1 supplier’s carmaker customer will have a vital interest in ensuring that its ESG policies pervade its entire supply chain. Accordingly, it will, contractually or through its factual influence on its supplier’s businesses, force the tier 1 supplier to carry out proper ESG due diligence of the business it seeks to acquire.

Investors. By the same token, financing sources may request the buyer to do and demonstrate appropriate ESG due diligence. Financial institutions are very much a driving factor of ESG and may request ESG compliance of its borrower (and by extension, an acquired business) in their financing documents, especially where the bank provides the acquisition financing for a specific deal. Similarly, shareholders, particularly those of listed companies, may expect or request proper ESG due diligence. The shareholder roster may include ESG-minded financial institutions or activist shareholders who are increasingly running ESG-centric campaigns.

Reputation. Evidently, buyers will have their reputation in mind when doing due diligence on a target business. Any carefully built ESG public image, with customers, suppliers, employees and other stakeholders can easily evaporate if an ESG-toxic business is acquired. NGOs and others will readily pick up any lapse.

ESG policies. Finally, a company’s own ESG policies will define the scope of the due diligence. The actual behaviour of a company is being carefully tested by stakeholders and NGOs against its own policies to identify and stigmatize greenwashing.

An expanded diligence scope will require amendments to information request lists, additional questions in the Q&A process, focus at expert sessions and a wider research in public sources.

1.2 ESG due diligence scoping

ESG considerations do not turn the due diligence scoping upside down but broaden the scope both vertically and horizontally. They require deeper analysis of areas that are generally covered by traditional due diligence, but they also command coverage of areas that previously may not have been captured. The below chart shows, on a high level, which areas need to be supplemented by ESG, vertically, and which areas need to be added, horizontally. As an example, compliance with law has of course always been a focus area of the legal due diligence covering a range of ESG matters. ESG-minded due diligence will also need to review compliance with soft laws such as standards, recommendations, and codes of practice. The prominent Milieudefensie v Royal Dutch Shell case has put that into sharp perspective. Environmental activists caused a Dutch court to effectively convert the soft law of the Paris Agreement on climate change into hard law, ordering Shell to reduce its global emissions by 45% by 2030.

As an example of the horizontal expansion, due diligence may now have to address diversity on boards, equal pay and less tangible matters such as corporate culture and the quality of business partner relationships. The way in which such criteria are reviewed and measured and the benchmarks against which the results are tested are very much a moving target. Some of the incremental due diligence may require non-traditional forms of diligence. For example, a bidder may want to interview suppliers and customers to get comfortable there are no ESG-toxic concerns.

1.3 ESG due diligence reporting

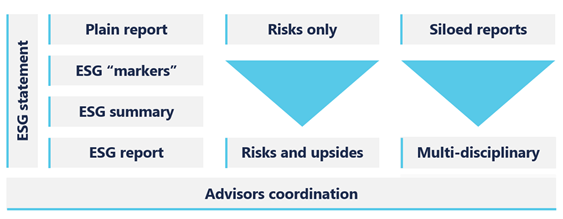

Some of the incremental topics to be covered by ESG-minded due diligence exercises are legal, some are technical, environmental, financial, strategic or tax matters. ESG-cognizant due diligence needs to cover the entire waterfront of ESG matters. That waterfront is too wide to be covered by one class of advisors, let alone one advisory firm. As in any proper M&A due diligence, each expert will do its review within its remit and coordinate its approach and findings with the other relevant advisors.

The way in which ESG related findings are reported varies and will depend on context. Is it sufficient to literally highlight ESG matters in a report? Or does the report need to contain an ESG summary? Or does the buyer need an actual full-blown “ESG only” report? And who is going to produce that? It is difficult to picture any advisor combining the qualification and experience to cover all ESG matters in sufficient depth and quality. However, ESG advisors, or experts within the client’s organisation, may be able to compile the ESG findings from various reports. This will make sure the client gets the full picture of the target’s ESG matters and can also be a useful tool to demonstrate at a later stage that ESG was front and centre when the buyer made its investment decision.

2. Impact of ESG on deal fundamentals

ESG issues identified in due diligence may well impact the fundamentals of an M&A transaction. Depending on the buyer’s ESG strategy and the gravity of the issue, such issues may be actual deal killers, impact the business plan and hence the valuation of the target business or require a deal structure that carves out or at least ring fences toxicity. ESG issues may also reduce the attractiveness of the deal for financing sources, and of the business for management, employees, and business partners. Again, the difficulty will lie in projecting the relevance of an issue in an ever-evolving ESG landscape and in quantifying the impact of the issue on the valuation of a business. (Reverse) Earn-outs may be a useful tool to capture future swings in valuation but the immediate challenge will be agreeing the metrics of such earn-out.

3. ESG in transaction documents

In many instances, ESG risks and issues will not change the fundamentals of the deal but call for consideration in the transaction documents. To date, ESG aspects have not yet given rise to truly novel, widely used SPA clauses, let-alone established market practices. However, as the relevance of ESG risks and issues continues to increase, we expect them to be addressed in the transaction documents in a broader, deeper and possibly tailored manner.

In essence, the established technology used in international sale and purchase agreements (SPAs) should suffice to meet the expanded requirements. Accordingly, the way in which ESG matters are addressed in the SPA will differ between actual issues and ESG-related risk.

3.1 Issues

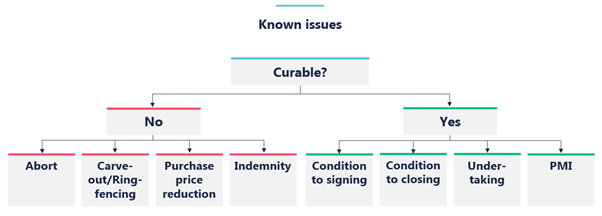

If the due diligence identifies an ESG issue, the way in which the issue will be addressed in the context of the transaction will depend upon the issue’s curability.

If, for example, the target business operates a factory that does not comply with environmental laws or the buyer’s ESG policies, in all likelihood such defect can be cured by (technical) modifications to the factory or to the way in which it is operated. If such remediation is fundamental to the buyer, the buyer will make SPA signing conditional upon the issue being remedied.

Such drastic approach may appear overdone if the curability, while being indispensable, is straightforward yet time-consuming. In this scenario, the buyer may be perfectly happy with the problem being rectified between signing and closing. If the factory is vital to the target business and compliance must be established by closing come hell or high water, remediation will need to be a closing condition. If the factory or compliance itself is of lesser relevance in the overall context of the transaction, a simple undertaking by the seller to address the issue promptly after singing may be enough. If the seller fails to deliver on that undertaking, the deal will still close, but the buyer may have a damages claim, possibly in a pre-agreed amount. Lesser issues may even be disregarded entirely in the SPA and put on the buyer’s to do list for the post-merger integration process, while possibly still being reflected in the buyer’s purchase price calculation.

Where it is not yet clear whether the issue will become relevant and what the operational and financial consequences will be if it does, an indemnity may be the best tool to overcome the uncertainty but will face the almost traditional averseness of sellers to indemnities and the likely inability to get W&I insurance coverage for indemnities.

3.2 Risk

Where any of the ESG topics are of particular relevance to the buyer, but no issues have been identified in the due diligence, risks can generally be addressed using the customary SPA toolbox. If the buyer is able to assert conditionality in the shape of a condition precent to closing (CP), e.g., in the shape of a MAC (Material Adverse Change) or MAE (Material Adverse Event) clause or a “no breach of warranties and undertakings” CP, these clauses may also capture ESG issues revealed between signing and closing. Since MAC/MAE and “no breach” CPs are traditionally open to interpretation (and inevitably debated if asserted by the buyer), it may be worth specifically addressing ESG matters in the drafting. For example, the CP could be tied to a minimum ESG rating downgrade, deterioration in ESG indicators, or press and social media coverage. Since none of these metrics are established standards yet, the negotiations are bound to be rather lively.

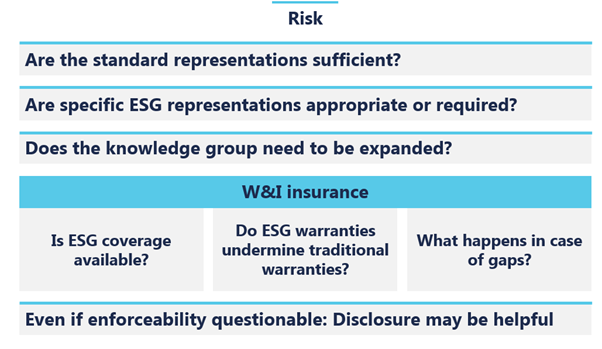

Beyond the applicability of CPs, most ESG risks can be covered by the standard set of warranties, most notably the compliance with law and the no-litigation warranty.

Some of the warranties may require modification and supplements to cover circumstances that have previously not been covered. Think of compliance with non-statutory guidelines or the target’s own policies. Another example is the buyer’s request for the (litigation or other) warranties to also cover pending or threatening NGO campaigns and quasi-litigation.

Some of the warranties may require modification and supplements to cover circumstances that have previously not been covered. Think of compliance with non-statutory guidelines or the target’s own policies. Another example is the buyer’s request for the (litigation or other) warranties to also cover pending or threatening NGO campaigns and quasi-litigation.

Other topics, if generally agreed to be covered by the warranties, require novel drafting, e.g., warranties on diversity levels, gender pay differentials, tax strategy aggressiveness, transparency metrics, to name but a few. The difficulties in defining the criteria and ultimately quantifying any damage incurred – how do you measure reputational/brand damage? – emphasize the importance of proper due diligence, which sellers should be mindful of when preparing a sale process.

It is worth keeping in mind, however, that warranties are not only about damages claims, but also about disclosure. So, even if a buyer ultimately cannot claim damages, the disclosure may still prove to be helpful in the buyer’s quest to understand the ESG profile of its purchase. Also, the mere fact that the topics were addressed in the due diligence and the SPA demonstrates to the outside world that ESG was front and centre when the deal was done.

W&I insurance has become a customary feature on larger M&A transactions in key jurisdictions and is generally also available to cover ESG matters. W&I insurers will apply their usual criteria to ESG issues as well, e.g., the requirement to do proper due diligence of an area for which coverage is sought, standard exclusions, no coverage of known issues, etc. No data is available yet, but it appears that inclusion of ESG does not automatically lead to higher premiums. Some insurers are considering offering specific ESG insurance. It is worth addressing ESG early on in the discussions with W&I insurers and brokers, as availability and scope of the coverage, pricing, exclusions and other key features of W&I insurance are a moving target.